Build Your Loan Management PlatformAll-in-One Loan

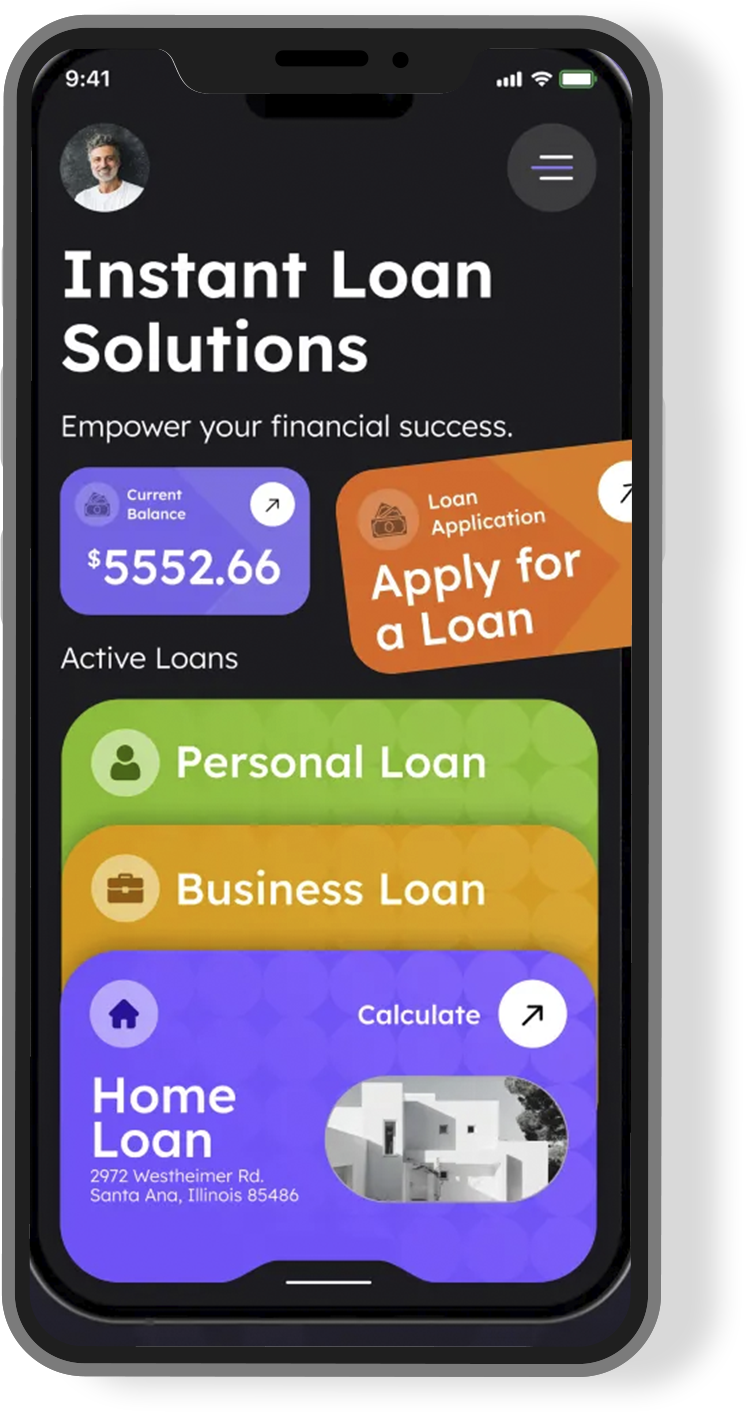

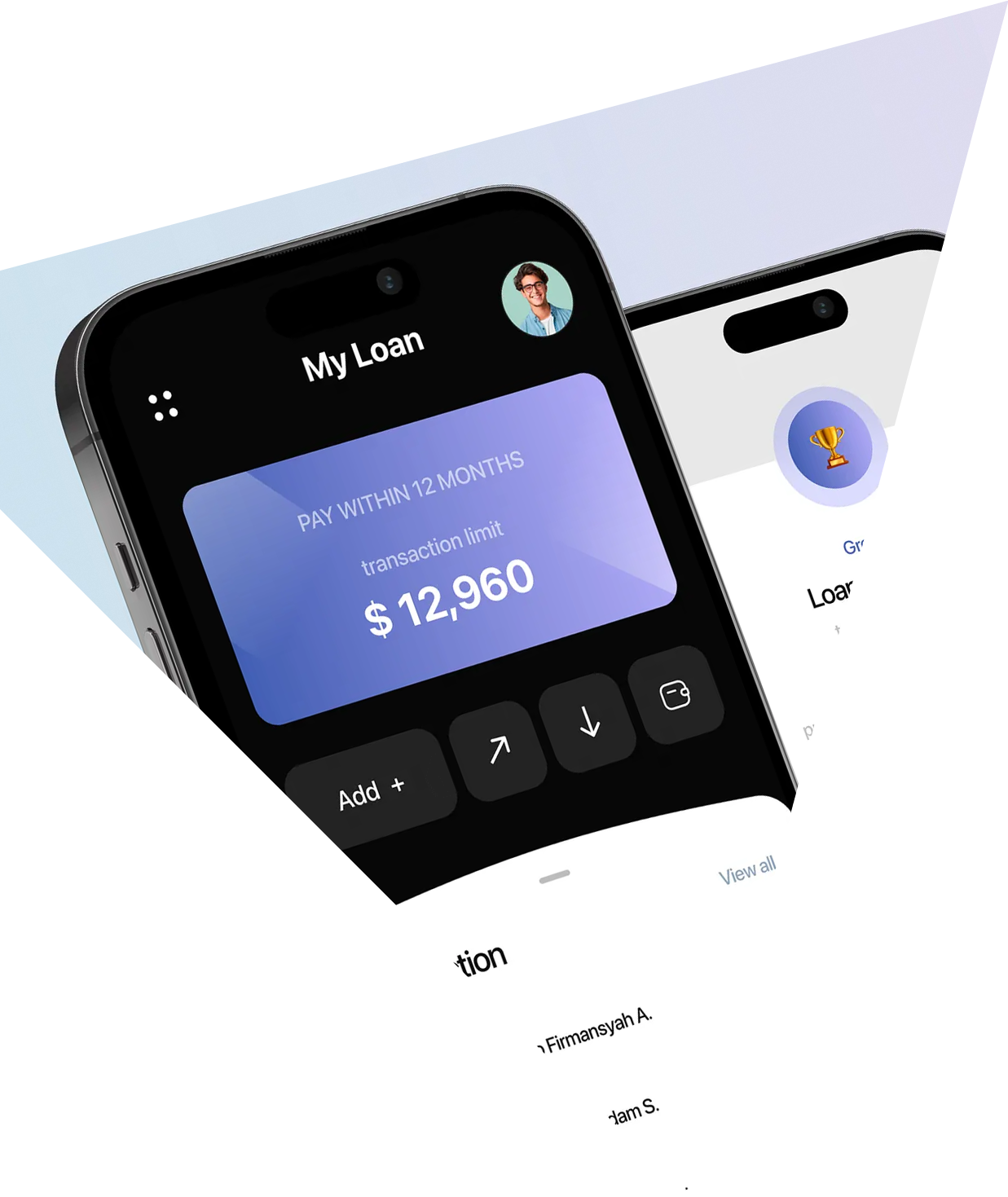

Management Software Development

Modern loan platforms are cloud-based, scalable, and easy to integrate with banking APIs, CRMs, and payment gateways. Whether you’re issuing personal, business, or education loans, we build systems that streamline every touchpoint.

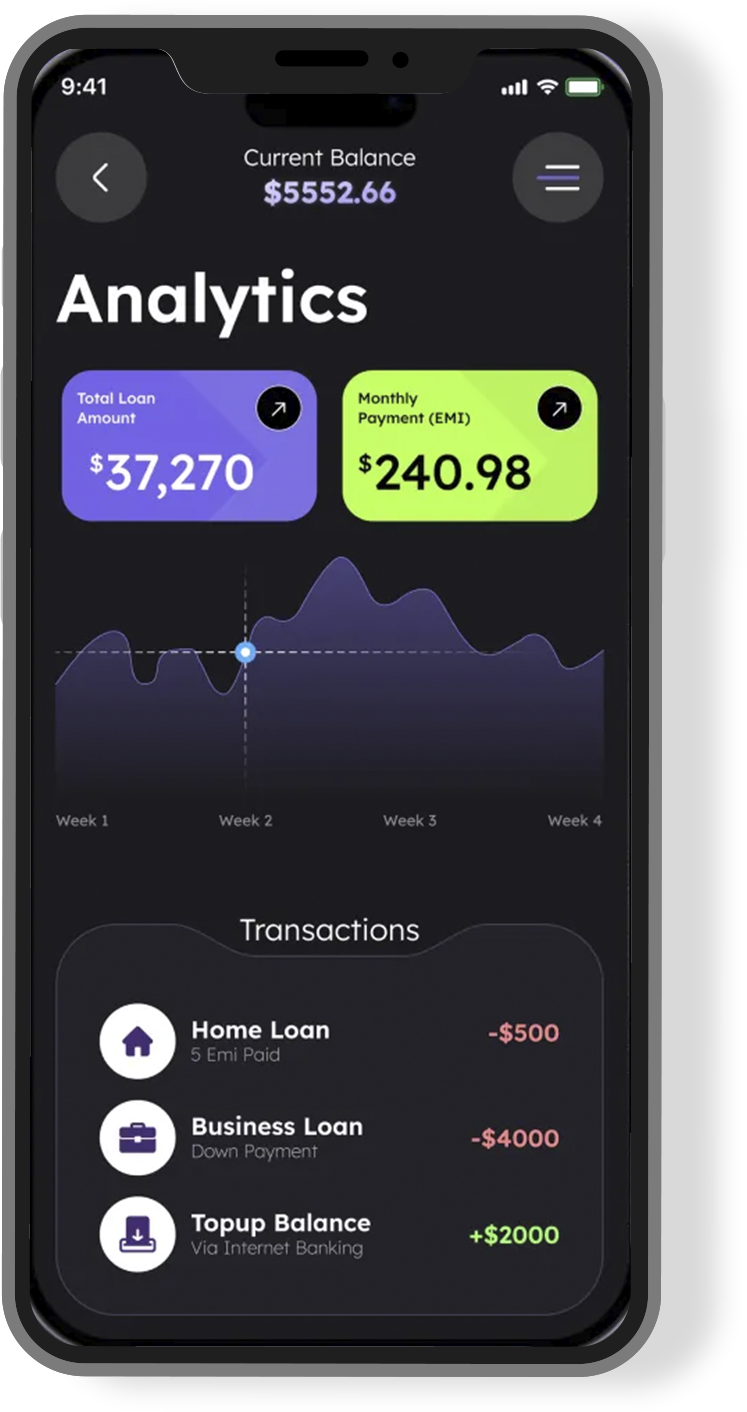

We help you manage KYC, risk scoring, loan disbursal, interest calculation, overdue alerts, and more from one smart dashboard.

Want to build a system like LoanPro

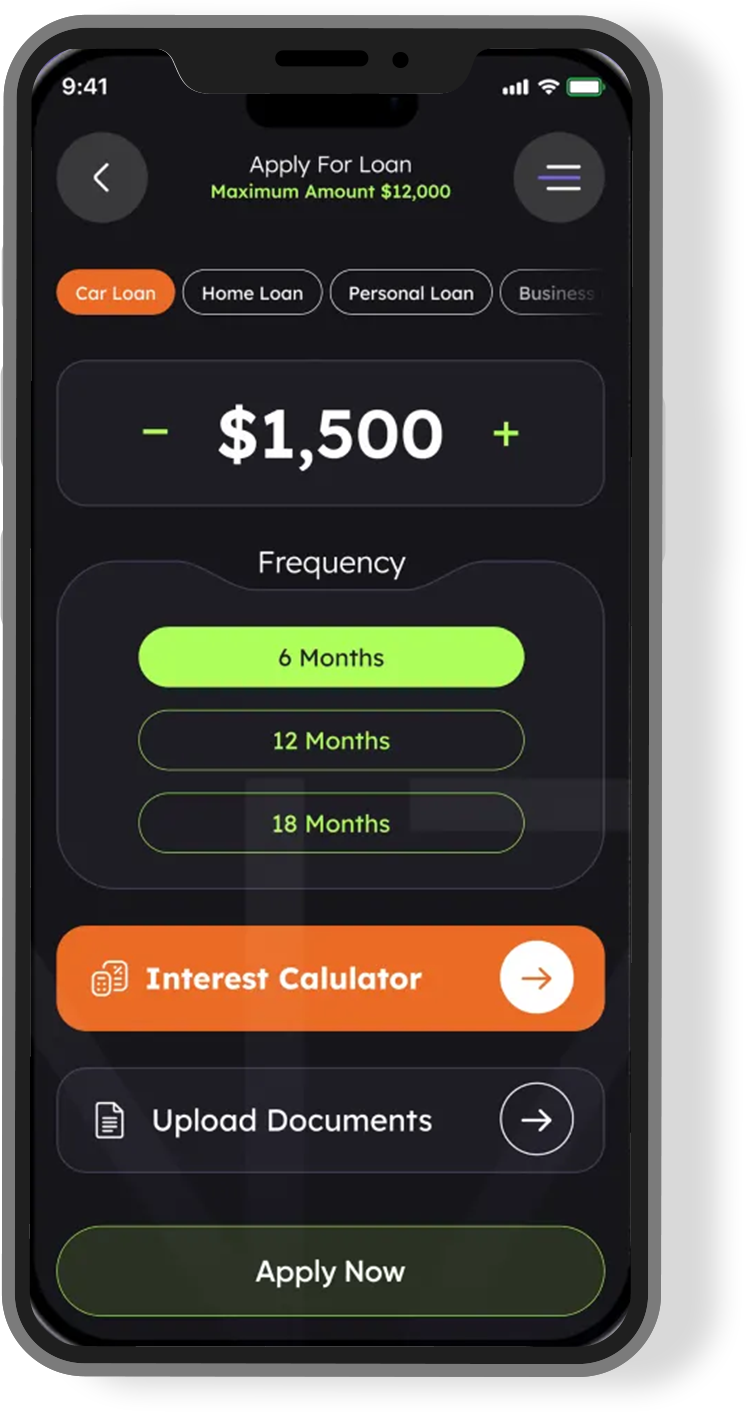

With AI-driven credit scoring, cloud infrastructure, and automated workflows, our loan management platform ensures faster approvals, better compliance, and secure data handling.

Our software is tailored to support various loan types and is designed to simplify complex financial processes.

Modules of our Loan Management Software

Key Features of Our

Loan Management Software

Client Words

A Legacy of Trust

Frequently Asked Questions

It’s a digital platform that automates the full loan lifecycle from application to repayment.

We build secure, scalable, and compliant systems tailored to your business.

Yes, including personal, gold, auto, payday, and business loans.

Yes, you can access the system anytime, anywhere.

KYC, CRMs, SMS gateways, payment APIs, Aadhaar, PAN, credit bureaus, and more.

Yes, it comes with integrated payment options and automated notifications.

Typically 4–8 weeks depending on features and complexity.

Yes, we follow financial compliance standards applicable in India and globally.

Yes, including loan summaries, repayment trends, defaulters list, and audit logs.